IN THIS ARTICLE

Enjoy a dream vacation, own a luxurious house or car or enroll your child in a course of her choice without worrying about the financial aspects. Axis Bank provides a home loan, personal loan, car loan, educational loan, and loans for purchasing commercial equipment at reasonable interest rates. Each of these loans can be obtained easily either by showing the proof of the regular income source or against a property, FD or the shares. The gold loan lets users obtain a loan against the gold. Applying for any of these loans is simple and quick. Eligibility for obtaining the personal loan is – the borrower should be above 21 years of age and below 60 years. A personal loan is offered for salaried employees, doctors, employees of private and public limited companies, and government undertakings. Choose the loan type you wish to obtain, enquire about the details of interest rates, charges, and other associated expenses. Provide the required documents and forms appropriately filled with all the required details. Initiate the loan request online for a quick approval. Customers can also call the customer care executive or visit the nearest branch to apply for the loan.

Axis Bank Personal, Home & Car Loans

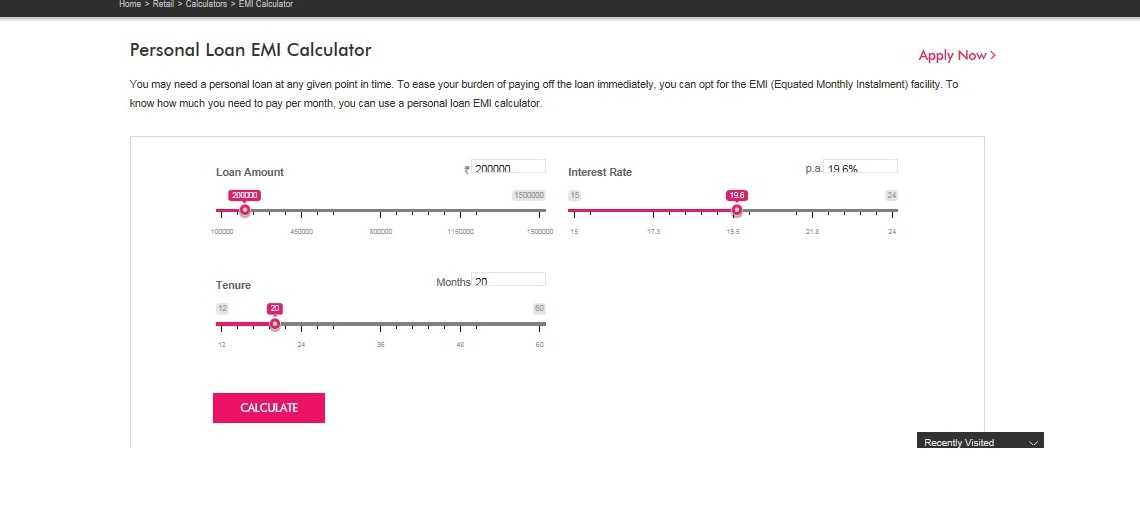

A personal loan is sanctioned for personal needs such as an extravagant wedding, memorable vacation, or for simple home renovation. The personal loan amount varies from a minimum of 50,000 to 15,00,000. Customers with the personal loan from other banks can transfer it to Axis Bank and save on interest paid. A personal loan can be availed to consolidate different types of loans into a single loan. The repayment tenure varies from 12 months to 60 months. Using the personal loan EMI calculator, users can find the easy to repay monthly EMI amount. Customers availing the Axis Bank personal loan can obtain eDGE Reward points depending on the loan amount. 150 points can be obtained for a loan amount of Rs. 3 lacs, 300 points can be obtained for a loan amount ranging from 3 lacs to 5 lacs and about 450 points for a loan amount above Rs.5 lacs. If in case you have any issues with loan accounts, for clarifying your query you can contact Axis Bank Customer Care.

The different types of home loans provided by Axis Bank include Pradhan Mantri Awas Yojna, Axis Bank Home Loan, Asha home loan, super save home loan, happy ending home loan, and the empower home loan. The loan amount, tenure, and the interest rates vary with the loan time. The interest rates can be either fixed or floating. Customers taking the home loan for their first house can save up to Rs. 2.67 lakhs. Under the Pradhan mantra Awas Yojna, the borrowers can obtain a subsidy on loan amount as per their financial status. SBI Loans also provides the home loans at low interest rate as Axis Bank. The minimum loan amount that can be obtained under the Axis Bank home loan scheme is about three lakhs and the maximum loan amount depends on the combined income. A minimum loan amount of Rs.1 lakh and a maximum amount of up to Rs.28 lakhs is offered for Asha Home Loan borrowers. Under the Empower home loan scheme, customers can get a minimum loan of 10 lakhs and a maximum of 150 lakhs. The super saver home loan is perfect for those requiring high amounts of loan ranging up to Rs.1 crore. The loan amount obtained through any of the above stated loans will be disbursed either partly or in full depending on the construction status of the property. You can check your status with Axis Bank Net Banking. Another interesting feature of home loans is that a top up loan can be availed on the existing home loan if the needs extend at a later date. The maximum amount of top up the loan that can be obtained is about 50 lakhs and tenure is same as that of the existing home loan.

The different types of home loans provided by Axis Bank include Pradhan Mantri Awas Yojna, Axis Bank Home Loan, Asha home loan, super save home loan, happy ending home loan, and the empower home loan. The loan amount, tenure, and the interest rates vary with the loan time. The interest rates can be either fixed or floating. Customers taking the home loan for their first house can save up to Rs. 2.67 lakhs. Under the Pradhan mantra Awas Yojna, the borrowers can obtain a subsidy on loan amount as per their financial status. SBI Loans also provides the home loans at low interest rate as Axis Bank. The minimum loan amount that can be obtained under the Axis Bank home loan scheme is about three lakhs and the maximum loan amount depends on the combined income. A minimum loan amount of Rs.1 lakh and a maximum amount of up to Rs.28 lakhs is offered for Asha Home Loan borrowers. Under the Empower home loan scheme, customers can get a minimum loan of 10 lakhs and a maximum of 150 lakhs. The super saver home loan is perfect for those requiring high amounts of loan ranging up to Rs.1 crore. The loan amount obtained through any of the above stated loans will be disbursed either partly or in full depending on the construction status of the property. You can check your status with Axis Bank Net Banking. Another interesting feature of home loans is that a top up loan can be availed on the existing home loan if the needs extend at a later date. The maximum amount of top up the loan that can be obtained is about 50 lakhs and tenure is same as that of the existing home loan.

Axis Bank provides three types of car loans. The new car loan that is generally offered online, starts from Rs.1 lakh onwards. The tenure for the new car loans is about 7 years. The pre-owned car loan that is offered on purchase of used cards starts from Rs.1 lakh onwards. The tenure for this type of car loan is about 5 years. The loan against a car that starts from about 10 lakh has a long tenure of about 15 years.You can also use secured Axis Bank Mobile App for Checking the loan status. Borrowers of car loans can obtain eDGE Reward points. About 350 points are awarded if the post disbursal documents are provided within 60 days of disbursing the first installment of the loan amount. A car loan is provided to every salaried and self-employed personnel. The documentation and online processing for car loans are simple, easy, and quick.

Axis Bank Loan Interest Rates & Loan Calculator

The interest rates for personal loans start from 15.50 percent and can be up to 24 percent which is in par with other banks such as Standard Charter Bank. Customers who fail to repay the loan amount should pay 24% of the overdue amount per year that is about 2 % of the overdue amount. Using the personal loan EMI calculator, customers can find the monthly installment to be paid and accordingly decide the loan amount and the tenure.

The interest rates on home loans vary from 8.35% to 8.70% depending on the loan amount. The interest rate on top up home loan is same as that of the existing home loan. The Axis Bank home loan interest rates are low compared to the other banks such as the Standard Chartered Bank and Punjab National Bank. The interest rates on car loans range from 11 to 12 percent which is close to that offered by HDFC Bank. Additional documentation charges of 500 should also be paid. Customers who fail to make the monthly installment have to pay a penalty of 2 percent of the loan amount. Compare Oriental Bank Of Commerce Interest rates and Loans with Citibank Loans and Dena Bank Loans for more savings.

FAQ’s Related to Axis Bank Loans

- How long does it take to obtain the approval for the personal loan after completing the application process and submitting the required documents?

2. What are the determinants for deciding the loan amount?

3. What is the tenure for Axis Bank personal loans?

4. What is the processing fee for applying for a personal loan?

5. What is the process for foreclosure of the personal loan?

6. What are the two different types of interest rates available on home loans?

7. What is the process of processing a home loan?

8. What is the fee for the processing of home loan request?

9. From when can the customer start paying the monthly EMI?

10. What are the different modes for repayment of the home loan?

11. What is security to be presented at the time of taking the auto loan from Axis Bank?

12. Is it possible to put the car for sale before repaying the loan?

13. What is the processing fee for car loans?

14. What is the interest rate on car loans?

15. How to remove the hypothecation from the car registration documents after repaying the loan?