IN THIS ARTICLE

Bank of Baroda Net Banking services gives the customers an opportunity to shop online without worrying about cash payment. With net banking services, customers can pay their bills or shop online using the Bank of Baroda Credit Card or the Bank of Baroda Debit Card. The net banking is highly secure protecting the customer details. The data transferred between the customer and the bank and all transactions are encrypted using sophisticated technology. Even the bank executives do not know the internet banking password of the users. All online transactions are authenticated at two levels to ensure the security of the payments.

Bank of Baroda Net Banking Registration and Login

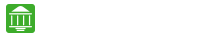

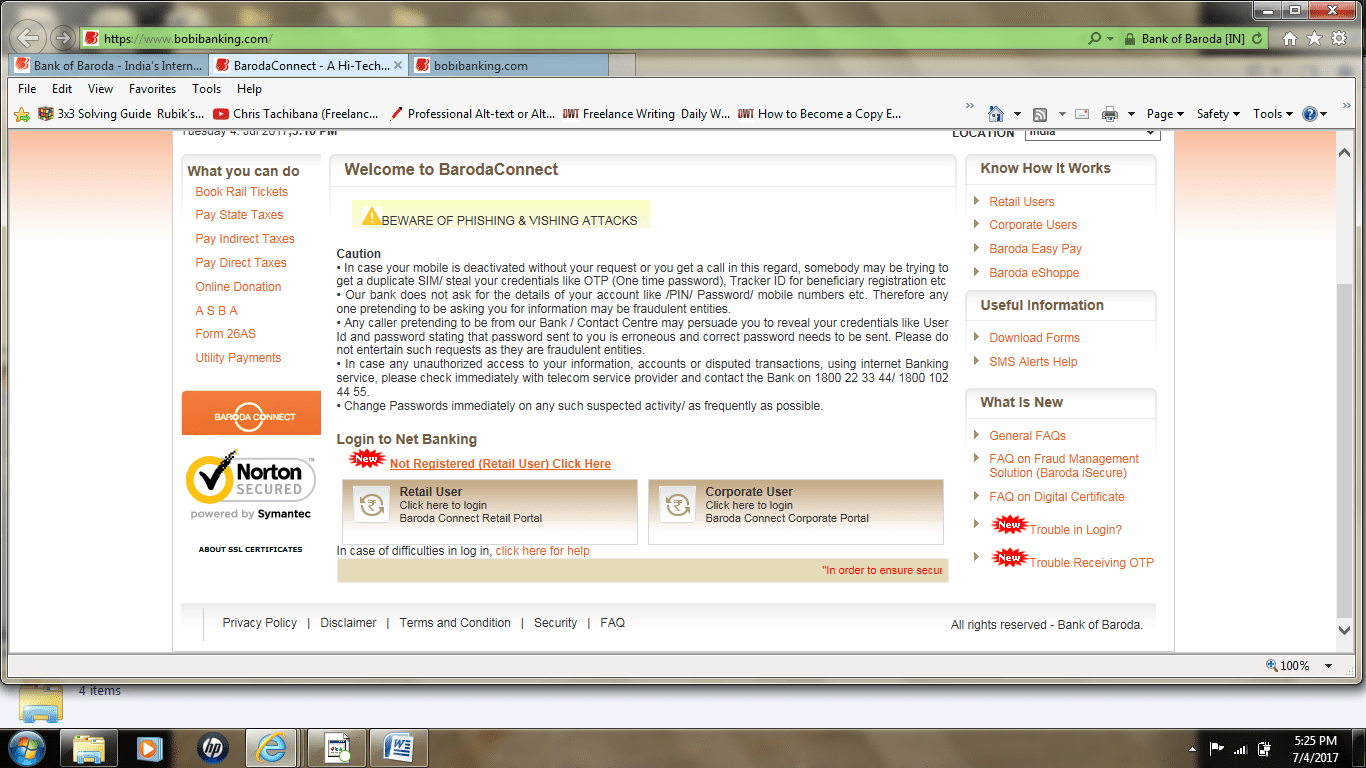

Customers who are new to Bank of Baroda Account or who have not registered for net banking services can do it online. To register for net banking services, access the Bank of Baroda website. Click on the link Not Registered (Retail User) link. It should be noted that this link is only for retail users who have not registered for net banking services.

In the form that opens, the customer is prompted to enter the debit card details. An OTP is sent to the registered mobile number. Enter the OTP in the form correctly. After authentication of the debit card, the customer is then prompted to set the user profile and create a User ID. After entering the required details click Next button. The customer is then directed to create the password both the sign-in and the transaction password. After completion of the registration process, the customer is provided a confirmation message of the same after 24 hours of completing the registration process. The registration process will be successful only if the debit card details entered by the customer are correct and the card is active i.e. the card has been used for the first time at Bank of Baroda ATM. Corporate users need to visit the branch to register for net banking services.If you face any problems with the online registration you can contact BOB Customer Care at any time for online assistance.

In the form that opens, the customer is prompted to enter the debit card details. An OTP is sent to the registered mobile number. Enter the OTP in the form correctly. After authentication of the debit card, the customer is then prompted to set the user profile and create a User ID. After entering the required details click Next button. The customer is then directed to create the password both the sign-in and the transaction password. After completion of the registration process, the customer is provided a confirmation message of the same after 24 hours of completing the registration process. The registration process will be successful only if the debit card details entered by the customer are correct and the card is active i.e. the card has been used for the first time at Bank of Baroda ATM. Corporate users need to visit the branch to register for net banking services.If you face any problems with the online registration you can contact BOB Customer Care at any time for online assistance.

To access the internet banking services, click the link “Baroda connect Retail Portal.” In the window that opens enter the User ID and click submit.

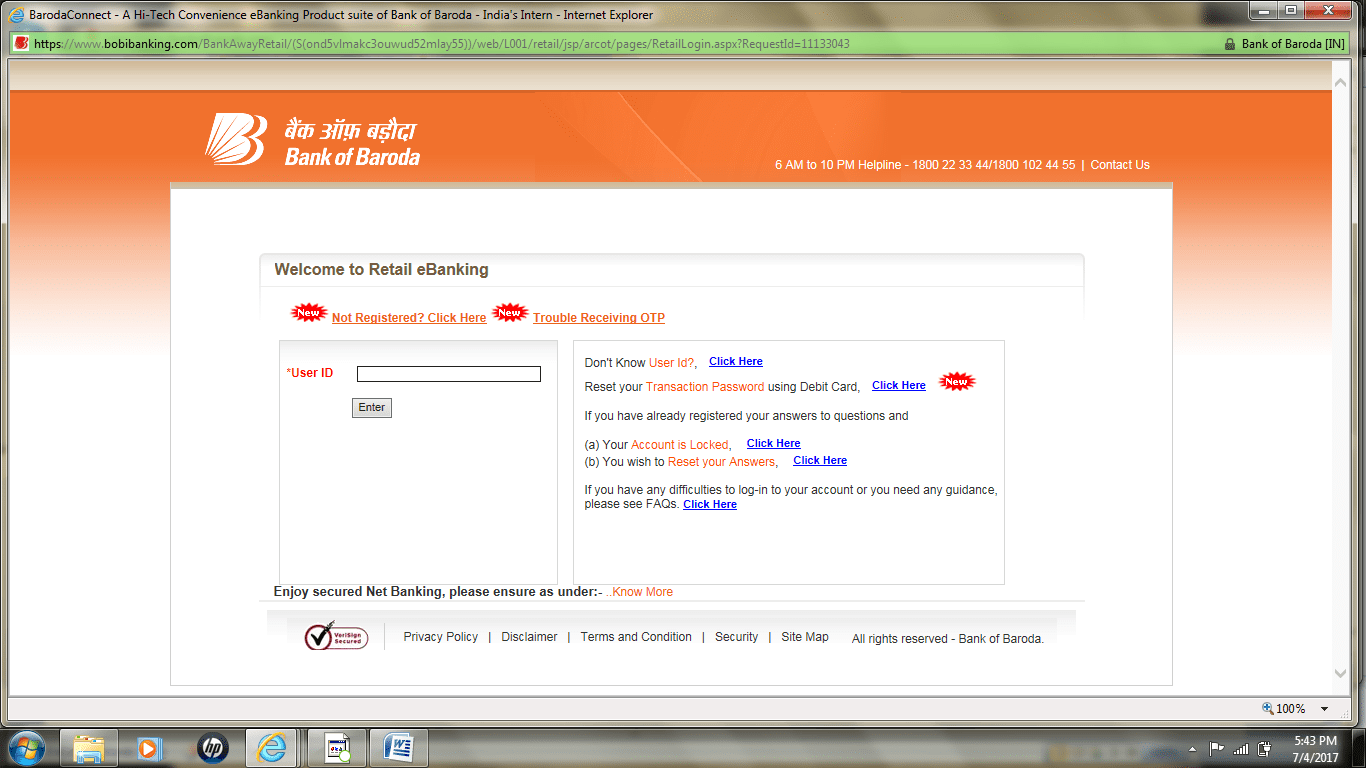

The customers is then prompted to enter the password. Customers who forget the user ID can retrieve the user ID. To retrieve the user ID, the customer can click on the link Don’t know User Id. The customer is then prompted to enter the account number, registered mobile number and the email address

The customers is then prompted to enter the password. Customers who forget the user ID can retrieve the user ID. To retrieve the user ID, the customer can click on the link Don’t know User Id. The customer is then prompted to enter the account number, registered mobile number and the email address

Customers can also change the transaction password and reset the answers for the security questions from the login page. If you are looking for any type of loans in BOB then Bank of Baroda Loans provides at low interest rates to their customers.

Customers can also change the transaction password and reset the answers for the security questions from the login page. If you are looking for any type of loans in BOB then Bank of Baroda Loans provides at low interest rates to their customers.

Bank of Baroda Net Banking Application

Baroda Connect is the net banking application that is provided by Bank of Baroda for its customers for safe online banking. The Baroda Connect application portal is easy to use. Customers can register for the net banking services very easily either online or by submitting the application at the bank. All the net banking services can be used free of cost. In the case of any discrepancy or help, customers can call the helpline on 1800223344 or 1800 1024455 in between 6 AM to 10 PM. The Baroda Connect service is available separately for both retail and corporate customers.You can also check the Kotak Mahindra Bank Net Banking and UBI Net Banking Applications here for better banking.

Bank of Baroda Online Banking

Online banking allows payment of a wide variety of bills including the state taxes. The different types of transactions that can be made with Bank of Baroda Net banking are Book rail tickets, pay state taxes, pay direct taxes, pay indirect taxes such as excise, make online donations and pay utility bills. Online banking service is available for both retail and corporate customers.

To make any of the transactions, click on the appropriate link displayed on the left side of the net banking page. The customer will be directed to the concerned page for example if the customer chooses to book rail tickets, the customer is directed to the IRCTC site. At the payment gateway, the customer has to choose to pay with the Bank of Baroda debit card and confirm the transaction by providing the transaction code and complete the transaction.You can compare the online banking of IndusInd Bank Net Banking and Dena Bank Internet Banking with BOB.

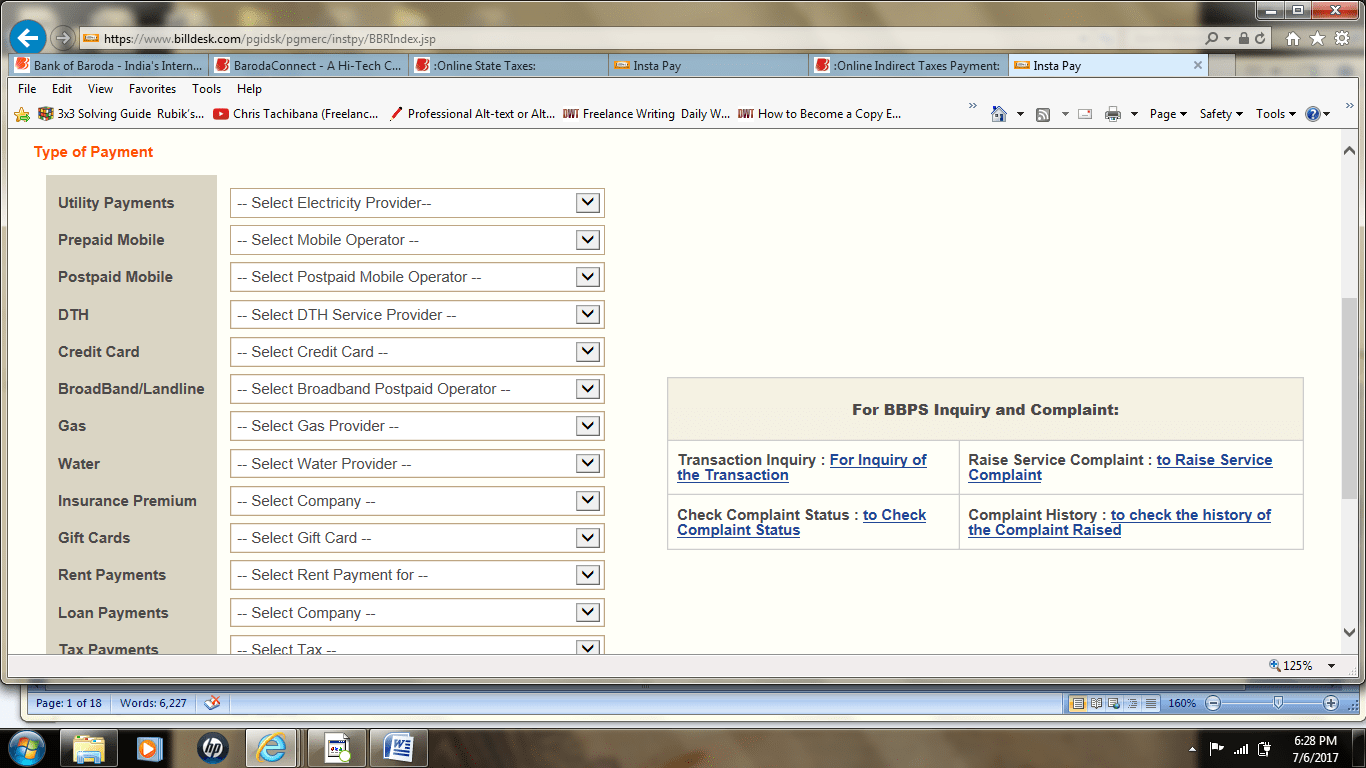

A wide range of utility bills can be paid using the online banking services. To pay the utility bills, the customer has to click the option “Utility Payments” on the left side of the net banking page. The customer is then directed to the terms and conditions page. Click “I Agree” option. The customer is then directed to the page providing the list of available types of payment options. It takes about 2 working days to complete any of the utility payments. Hence, the customers have to make the payment well before the due date to avoid late fees or disconnection of the services.

Customers who wish to pay the electric utility bill should choose the appropriate electricity service provider from the drop-down and click submit. The customer is then prompted to enter the service number and the amount to be paid. click submit. In the window that opens enter the required details to complete the transaction.

Customers who wish to pay the electric utility bill should choose the appropriate electricity service provider from the drop-down and click submit. The customer is then prompted to enter the service number and the amount to be paid. click submit. In the window that opens enter the required details to complete the transaction.

Prepaid Mobile Recharge

Prepaid mobile recharge can now be done from the comfort of the house using the Bank of Baroda Insta Pay services. From the drop-down select the Prepaid mobile service provider and the payment mode – Bank of Baroda retail or Bank of Baroda Corporate and click submit. The prepaid mobile operators partnering with Bank of Baroda are Aircel, Reliance GSM prepaid, Airtel, BSNL prepaid, Docomo CDMA, Docomo prepaid, Loop Mobile, Uninor, MTNL, Jio, and Vodafone. You can also do the prepaid mobile recharge with the help of IDBI Net Banking. The customer is prompted to enter the mobile number and the recharge amount. Click submit. Complete the transaction providing the required details. Choosing the Insta Pay not only eases the prepaid mobile recharge but also lets you enjoy special offers such as obtaining an extra talk time for the same recharge amount.

You Can Also Check Here For Best Features of BOB

- Benefits of having Bank of Baroda Accounts

- offers on Bank of Baroda Credit Cards

- How to Open Bank Deposit Accounts Online in BOB

Postpaid Mobile Bill Payment

Pay your postpaid mobile bills before the due date with the Bank of Baroda InstaPay service. Choose the mobile operator, select the payment mode and click submit. The available list of mobile operators includes Idea, Reliance, Tata Docomo, Aircel, Airtel, and Vodafone. In the window that opens enter the postpaid mobile number and the bill amount. Click Submit, to continue with the payment process. Enter the details of the debit card number and the transaction password to authenticate the transaction. The amount will be deducted from the account and credited to the service provider.

DTH Recharge

Like the prepaid mobile recharge, Bank of Baroda Insta Pay users can recharge the DTH card anywhere anytime. The DTH Recharge service is available for Big Tv, Dish Tv, Videocon, TataSky, Airtel, and Sun Tv. Choose the DTH service provider, the payment mode and click submit. In the window that opens enter the subscriber number, recharge amount, and the customer details such as the name, registered mobile number, and the Email address. The customer is then directed to the payment gateway. Enter the credit card or the debit card from which the payment is to be made and complete the transaction.

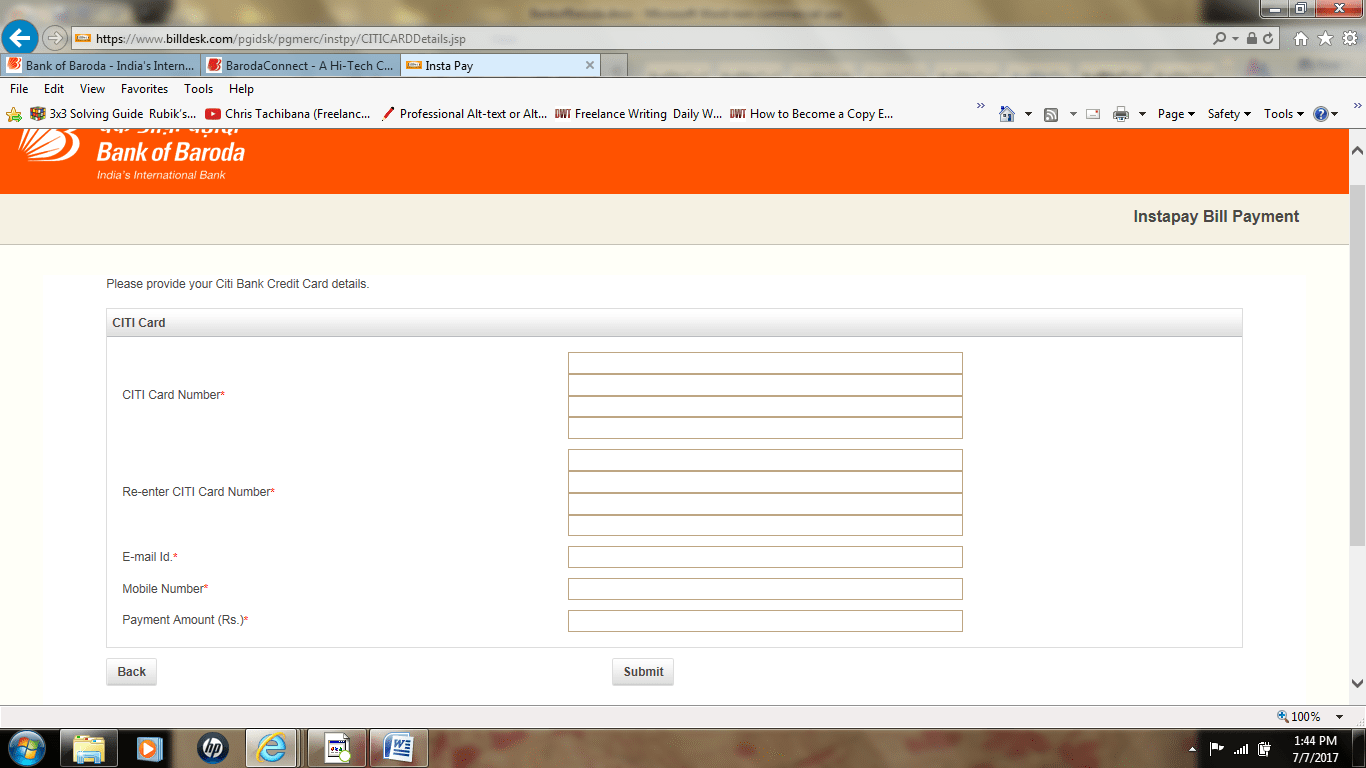

Credit Card Bill Payment

Bank of Baroda Insta Pay services can also be used to pay Axis Bank, PNB, BoB Card credit card, SBI, Band Of India, Citi Bank, IndusInd, Yes Bank, RBL and Kotak Bank credit card bills. From the available list select the bank credit card for which the payment is to be made, select the payment mode and click submit. The customer is then prompted to enter the details of the credit card for which the bill is being paid, bill amount, and the customer details such as the email ID, name, and the registered mobile number.

Enter the required details and click submit to proceed to the payment gateway and complete the process.

Enter the required details and click submit to proceed to the payment gateway and complete the process.

Broadband or Landline

Broadband or the landline bill from the service providers ACT Broadband, MTNL Delhi, Airtel, MTNL Mumbai, BSNL, TATA Docomo, Airtel, Tikona Digital Networks limited, and Connect Broadband can be paid online using the BOB credit or debit card. Select the broadband or the landline service provider and the payment mode and click submit. In the window that opens enter the broadband or landline connection details.

Pay Gas Bills

Gas bills from Gas service providers – Adani Gas Gujarat and Haryana, Gujarat Gas Limited, Indraprastha Gas Limited, Mahanagar Gas Limited, Siti Energy – Delhi, Haryana, and Uttarpradesh can be paid online using the Bank of Baroda credit or debit card. Enter the correct gas service number to prevent failure of transaction.

Pay Water Bill

Water bills from the service providers Delhi Jal board and Uttarakhand jal sansthan can be paid using the BOB InstaPay services. Enter the k.no and other customer details appropriately. Click submit. Provide the BoB credit or debit card number or the other bank credit or BOB Debit Card number, authenticate the transaction and complete the payment.

Pay Insurance Premium

Insurance premium from insurance service providers such as Bharati Axa Life insurance, ICICI Bnak prudential life insurance, Max Life, Edelweiss Tokio Life insurance, SBI life insurance, PNB MetLife India Insurance, and TATAAIA Life insurance can be done using the Bank of Baroda InstaPay service by just providing the policy number.

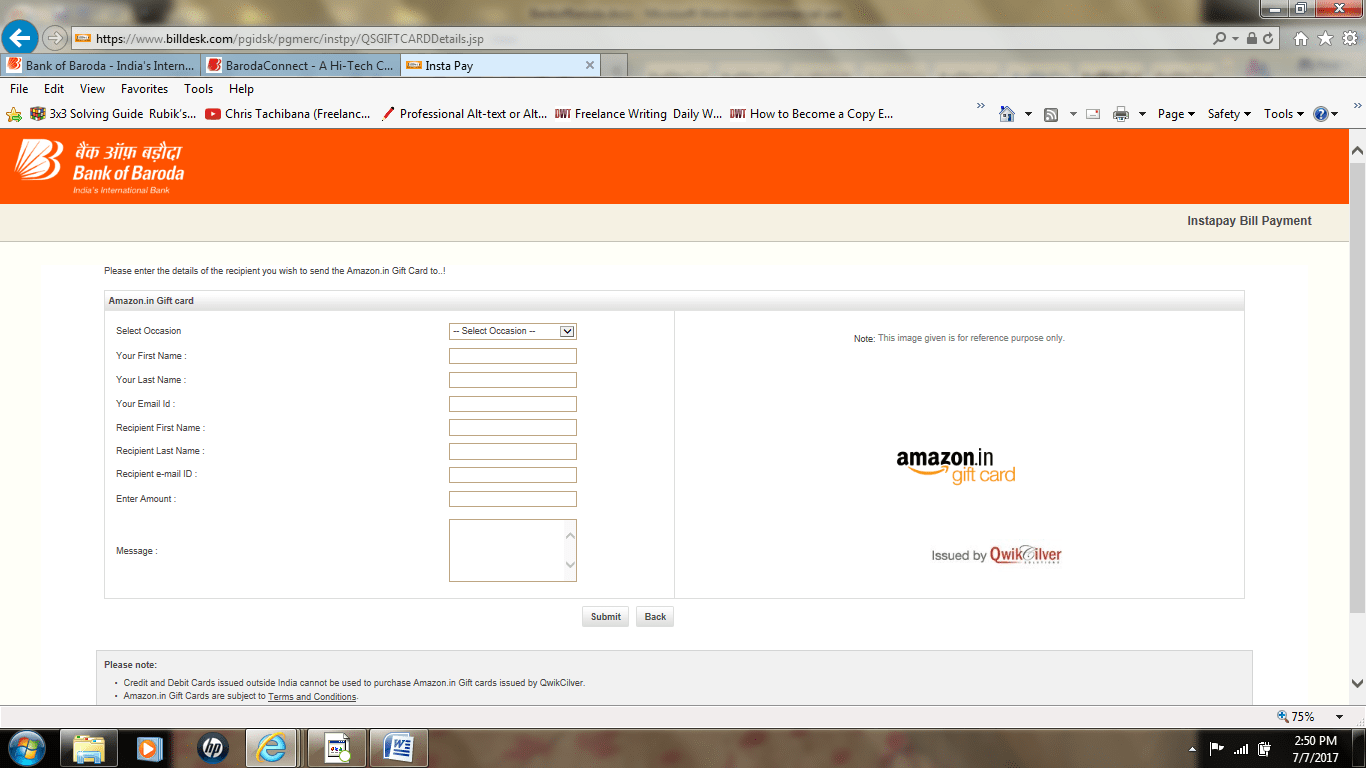

Purchase an Amazon Gift Card

Presenting a gift to your loved on a special occasion is often a very difficult task. Make it simple yet, special with the Amazon Gift card. Shop for Amazon gift card at Bank of Baroda in just few clicks. Enter the details such as the address of the person to whom the gift is to be sent and your personal details that are required to successfully process the transaction. Customers are also provided with an option to enter a short message that is sent along with the gift card to the intended recipient.

The usage of the Amazon gift card will have to be done as per the terms and conditions defined by Amazon. Ensure to use only debit or credit card issued in India to purchase a gift card as cards issued outside India are not valid for gift card purchase.

The usage of the Amazon gift card will have to be done as per the terms and conditions defined by Amazon. Ensure to use only debit or credit card issued in India to purchase a gift card as cards issued outside India are not valid for gift card purchase.

Pay Rent

Customers using the real estate properties of RedGirraffe.com can pay the rent online with the Bank of Baroda InstaPay service. Choose the RedGirraffe.com option in the drop-down included in Rent Payments. In the window that opens enter the RedGirraffe ID and the registered mobile number to proceed to the payment gateway.

Make Loan Payments

late payment of monthly loan EMI makes the borrower pay extra interest on the outstanding due amount. It even lowers the credit score. To prevent such hassles schedule your loan payments with Bank of Baroda by providing standing instructions. Bajaj Finance, HDFC Bank Ltd, and Bajaj Auto Finance loans can be paid online using the Bank of Baroda InstaPay service. Enter the loan account number to initiate the payment process.

Pune Municipal Corporation property tax can be paid online with the Bank of Baroda InstaPay services. To pay the property tax, the user has to provide the details such as registered mobile number, property ID, and the Email Id. The tax payment will be complete only after the authentication of the transaction by the user. Entering incorrect details would cause rejection of payment.

Subscribe to a magazine: monthly subscription to magazines – India Today, Reader’s Digest and any magazine from Hindu Group of Publications can be paid using the Bank of Baroda InstaPay service. Even the initial subscription fee can also be paid online. After paying the amount through Bank of Baroda Net Banking services, the customer will start receiving the magazine after a short period of one month. Any discrepancy related to the issue of the magazine is not dealt by Bank of Baroda. The customer should post a complaint to the publisher to resolve the issue.

You Can Also Check For Better Banking Experience

- Bank of Baroda Customer Care Center – Phone Numbers & Address

- Spend Wisely With Bank of Baroda Debit Cards

- Mobile Banking Made Easy with Secure Bank of Baroda Mobile App

Make Donations Online

Bank of Baroda Net banking services can also be used to make donations for different organizations such as Cancer Patients Association or for other organizations working for various causes. To make the donations, the customer should provide the name, email ID, cause for donation, address, and the phone number. The organization to which the donation is made ensures that the contribution is made to the concerned person. A short delay may be expected before the payment is given to the recipient depending on the payment process of the concerned organization.

Processing of the utility bill payments generally takes about two to three working days. To prevent late payments, the customers should schedule the payments before the due date. Apart from the utility bill payments, customers can pay state and central government taxes. To pay the state government taxes, choose the option – pay state taxes on the left side of the retail net banking page. You can also use the BOB Mobile Banking App for payments.

To ensure the security of the online transactions customers are suggested to be aware of the phishing attacks such as emails requesting for a password, mobile numbers, account related details or the PIN. Bank of Baroda never sends such emails to the customers. It is also recommended for the customers to not reveal the confidential information to callers pretending to be bank executives. Customers should check the transaction regularly, in the case of identification of unauthorized transactions, a report of it has to be made to the customer care for appropriate action.

FAQ’s Related to Bank of Baroda Net Banking

- How to apply for internet banking services?

2. Is it possible for the retail customers to increase the transaction limit?

3. How to pay utility bills using net banking services?

4. Why attempts to register for online banking service fail repeatedly?

5. What to do if the internet banking password expires?

6. Can the user start paying utility bills immediately after registering for internet banking services?

7. What is the eligibility for using the digital signature facility?

8. What are the categories of Digital Signature Certificates for which the DSC is applicable?

9. Is it mandatory for the corporate users to use the DSC?

10. Is it possible for the corporate customers to unregister from the DSC services once registration is complete?

11. What is Baroda iSecure?

12. How does Baroda iSecure ensure the security of internet banking?

13. What are QnA and OTP?