IN THIS ARTICLE

- Standard Chartered Bank Credit Cards Apply Online & Status

- Standard Chartered Bank Credit Card Payments

- Standard Chartered Bank Credit Cards Customer Care

- Standard Chartered Bank Credit Cards with Offers

- Standard Chartered Bank Debit Cards with Offers

- FAQ’s Related to Standard Chartered Bank Credit Cards & Debit Cards

Individuals with a savings account or current account with Standard Chartered Bank can obtain the debit card. A credit card can be obtained by applying for it either online or by phone banking. Standard Chartered Bank provides different varieties of credit cards and debits cards each with a different set of privileges tailored as per the customer requirements. The cards can be used anywhere across India and the globe.

To know More About Banking Check Here

- Advantages of having SCB Accounts

- Benefits of Bank Deposits with SCB

- SCB Loans at Low Interest Rates

Standard Chartered Bank Credit Cards Apply Online & Status

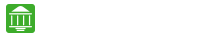

Applying online for a credit card is simple and quick. To apply for a credit card, click on the credit card tab on the home page, select the card of your choice. You can also use Secured Standard Charted Net Banking to apply for credit card.

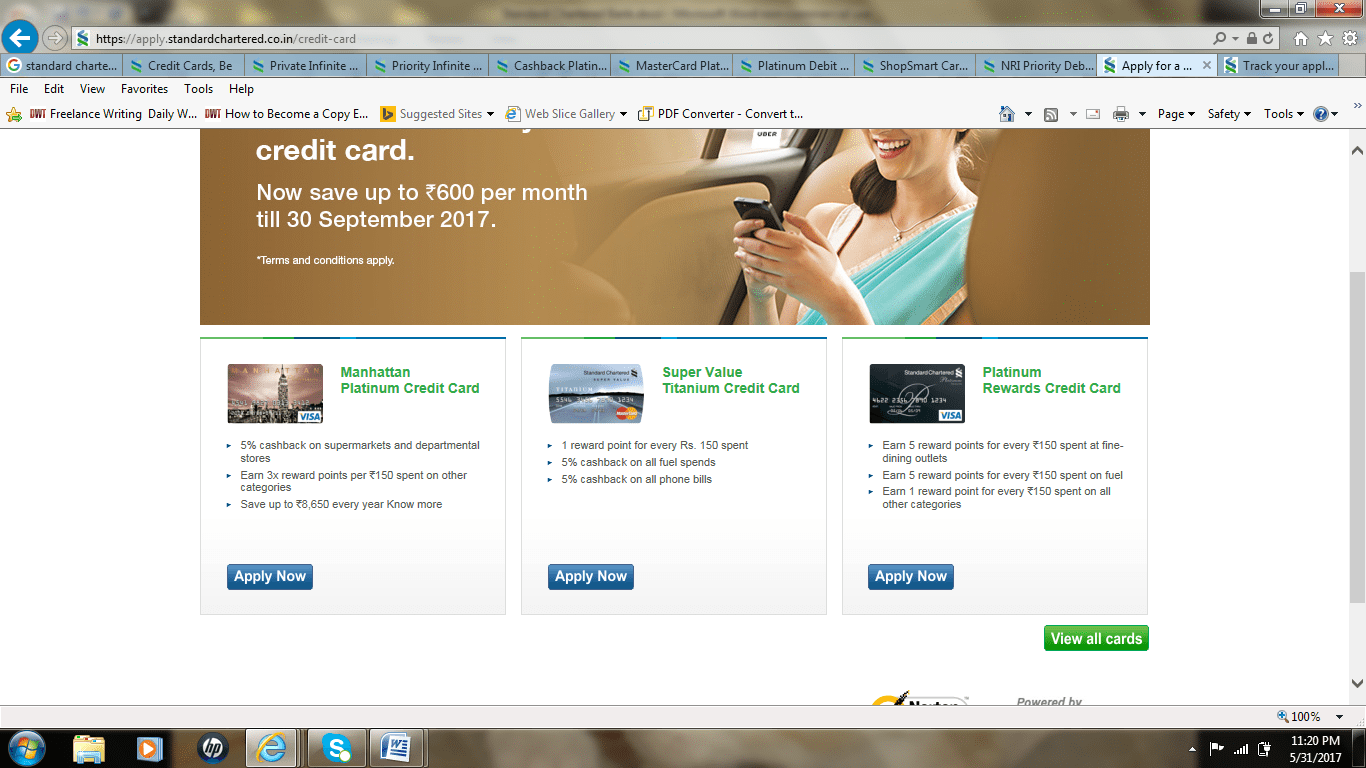

In the window displaying the card details, Click the Apply Now button.

Fill in the required details in the form that opens and click the Proceed button. After submitting the form, the customer will be given an instant approval.

Provide the required documents as suggested by the bank executive who contacts the customer after completion of the approval process. After completion of processing the request, the card will be delivered to the customer within 7-15 days. Rarely, the process may take more time. If you are looking for bank loans at low interest rate then SCB Loans suits for your needs.

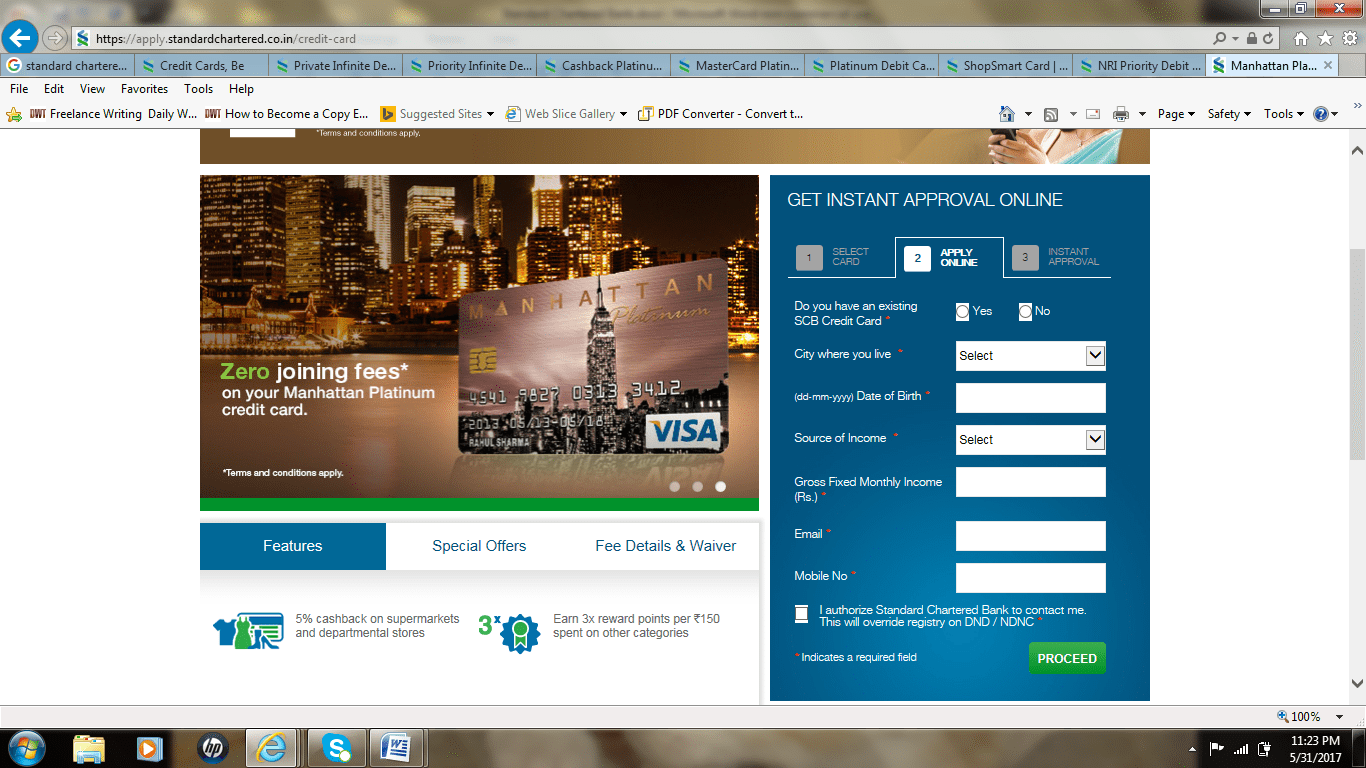

After applying for the credit card online, the customer will be sent an application reference number which can be used to track the status of the application. To track the status of the application, select the credit card option on the home page. In the list of options displayed click on the “Track Credit Card Application” option. The following window opens.

Check Here Also For Hassle Free Banking Experience

Check Here Also For Hassle Free Banking Experience

- Secured Net Banking Services by SCB

- How To Use SCB Mobile Banking App

- SCB Customer Care Center – Phone Numbers & Address

Enter the required details the – application reference number and the registered phone number. Click the submit button to know the status of the application. Customers who forgot reference number can click on the forgot reference number link. If have any issues with application you can contact SCB Customer Care for online assistance with out visiting the bank personally.

The customer will be prompted to enter the email ID. Enter the valid Email Id and click Go. The application reference number will be sent to the email ID.

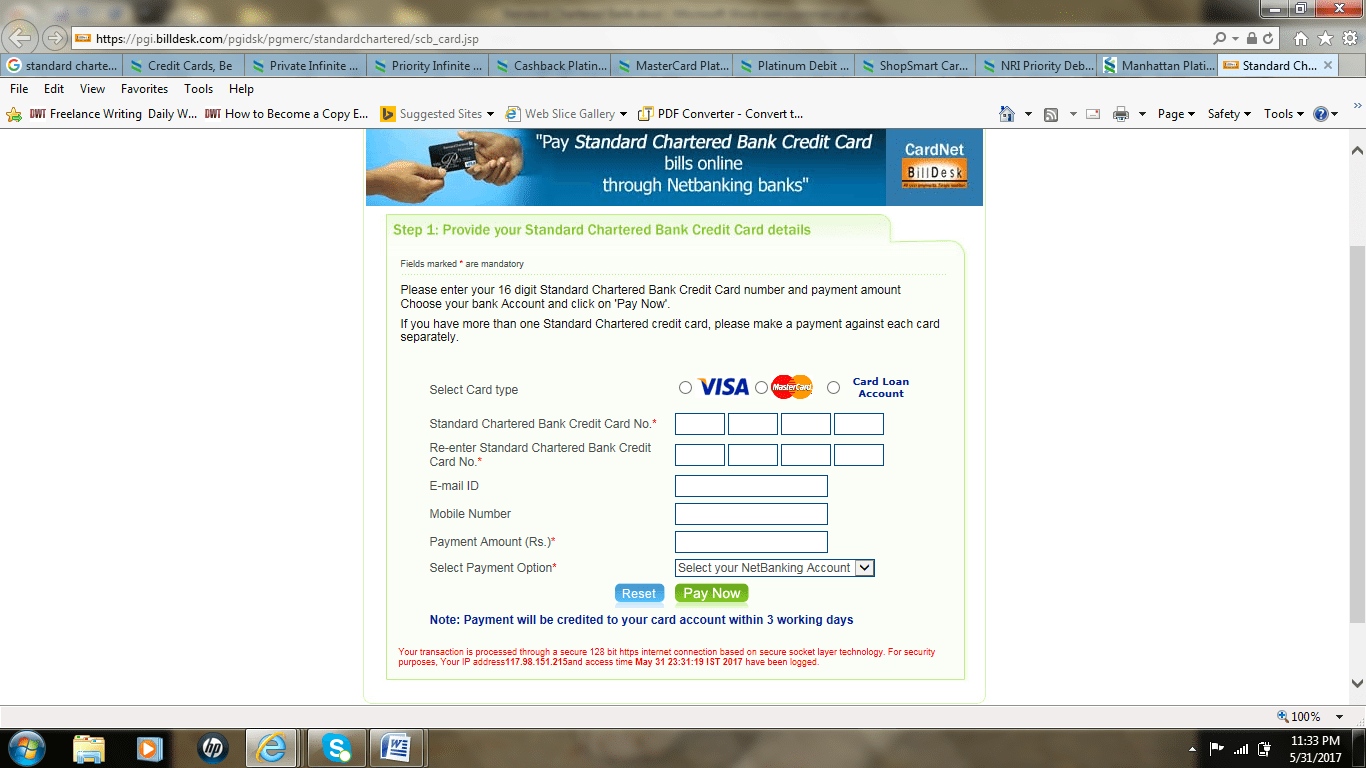

Standard Chartered Bank Credit Card Payments

Standard Chartered Bank credit card bill can be paid via multiple means. The simplest way is to pay the bill online using the online banking services. To pay the bill online, customer can login the online banking account and choose to pay the credit card bill option. The following window opens. Also use SCB Mobile App for hassle free bill payments.

Enter the required details and click Pay Now button to complete the payment process. Standard Chartered credit card bill can also be paid from other bank accounts using the NEFT or IBFT service. The IFSC code to be provided at the time of payment is SCBL0036001 and the address as MG Road, Mumbai.

Credit cards that are under Visa franchise can be paid using the Visa Money Transfer with payment of small fee. Credit card bill payment can also be done by submitting a cheque or demand draft in favor of Standard Chartered Bank card number into the cheque collection boxes. Also use Standard Charted Net Banking for bill payments.

All credit card payments have to be paid at least 3 days before the due date to ensure that the bill is cleared to avoid penalty charges for late payment. The credit limit will be re-initiated after receiving the payment. Customers with multiple credit cards should provide a clear instruction about the payment that is the card for which the payment is being done. In the case of submission of the cheque, mention the allocation of the amount to each card at the back of the cheque. Credit card payments can also be made by cash at the bank branch. Also check the payment process for HSBC Bank Credit Cards and IDBI Bank Credit Cards.

Standard Chartered Bank Credit Cards Customer Care

Credit card or debit card related concerns can be sent by email to [email protected]. The complaints can also be sent by fax to 080-66959595. Before using the mail or fax services, customers can check the frequently asked questions section of the credit card or debit card to find an answer for their concerns. Another way to get it answered immediately is through phone banking. To resolve the credit card disputes via phone banking, the customer should have the credit card number and the account number handy.

Standard Chartered Bank Credit Cards with Offers

Standard Chartered Bank provides exclusive benefits for its credit card users. The benefits that can be availed are 360 degrees rewards program, card activation offer, value added benefits, anything on EMI, and extra bonus points. 360 degrees reward program lets customers redeem the points for exciting items such as the Apple iPhone 6s 16GB for 2,19,500 points. Use of the card for online banking within 2 months of activation gives 1500 reward points. Enjoy discounts of up to 15% on flight bookings or about 25% discount at Jabong.com. Another interesting feature of Standard Chartered credit cards is the conversion of spends into an EMI. If you are looking for much better offers on credit cards then the following banks Dena Bank Credit Cards, United Bank of India Credit Cards and Bank of Baroda Credit Cards provides the great offers.

The different types of credit cards available from Standard Chartered Bank are:

Landmark Rewards Platinum Credit Card

- Perfect for shopaholics who shop frequently at branded stores such as Max, Lifestyle, and other Landmark group of stores.

- Payments of higher value can be paid using the card at a lower interest rate.

- 5% cashback during the sale time at Lifestyle, Home Center and SPAR stores.

- Coupons worth Rs.2,800 can be obtained using the Landmark rewards platinum credit card.

- Each point earned using the card can be redeemed for Rs. 0.60.

- 2x rewards points for the amount spent at other stores.

- Resolver facility that gives the feasibility to pay only 5% of the outstanding amount every month.

Super Value Titanium Card

- Provides super savings on telephone and fuel bills.

- 5% cashback at petrol pumps.

- 5% cashback on payment of telephone and utility bills.

- One reward point for every Rs.150 spent using the card.

Platinum Rewards Card

- Exciting offers on lifestyle, movie tickets, travel bookings, and dining.

- No card usage charges. Free for life-time for customers who apply for the card online.

- 5x rewards at fuel pumps.

- 1 reward point for every Rs.150 spent using the card.

- 5x reward points at hotels and dining outlets across India and overseas.

Manhattan Platinum Card

- 5% cashback on money spent at supermarkets and grocery stores such as More, Big Bazaar, Reliance Fresh, and Food Bazaar.

- 3x reward points on all payments at hotels, dining, fuel, and airline ticket reservation.

- Easy payment options.

- Cashback of Rs.500 every month and Rs.150 per transaction worth Rs.1000.

Standard Chartered Yatra Platinum

- Ideal for travelers.

- Gift voucher of Rs.4000 as a welcoming gift from Yatra.com.

- 10% cashback on the amount spent at Yatra.com.

- Tickets booked at Yatra.com can be canceled without paying the cancellation charges.

Priority Banking Visa Infinite

- Special benefits for priority banking customers.

- No annual fee for using the card.

- Access to more 2,000 golf courses in India.

- Airport lounge access.

- 5x reward points for using the card at fashion stores and overseas.

- 2 reward points for every Rs.100 spent at other stores.

- Special offers at www.bookmyshow.com during the weekend.

Standard Chartered Bank Debit Cards with Offers

The different varieties of Standard Chartered Bank debit cards and the offers available with them are –

Private Infinite Debit Card

- 2 reward points will be credited to the card for every Rs.100 spent.

- The points can be redeemed for cash.

- Access to airport lounges.

- No surcharge at petrol pumps when paid using the Private Infinite Debit card.

- One movie ticket free with the purchase of one ticket using the card.

Priority Infinite Debit Card

The benefits of using the Priority infinite debit card are:

- 2 reward points for every Rs.100 spent at merchant outlets.

- BOGO offer on movie ticket bookings.

- zero surcharge for use of the priority infinite debit card at any of the petrol pumps.

- Free access to airport lounges in India.

- Points earned on using the card can be redeemed for cash.

- Enjoy special offers at branded stores in the categories of lifestyle, Fine dining, health and fitness, and travel.

Cash Back Platinum Card

- As indicated by the name, the cash back platinum card users can enjoy 5 % cash back on all transactions worth Rs.750 and above. The maximum cash back amount per transaction is Rs.100.

- An amount of Rs.2,00,000 can be spent on daily purchases or at ATMs.

- Enjoy unlimited discounts, deals, and privileges at branded stores in the different categories – Lifestyle, Fine Dining, health and fitness, and travel.

- Enjoy Standard Chartered Bank offers

- 10% discount on flight bookings and 5% cashback at Emirates.com.

- 15% discount on flight bookings at BigBreaks.com.

- 25% discount at jabong.com.

- 20% discount on car rentals at mylescars.com.

Master Card Platinum Debit Card

- No surcharge at petrol pumps.

- One reward point for every Rs.100 spent using the card.

- A daily spending limit of Rs.1,00,000 at ATMs and at merchant stores.

- Special offers related to lifestyle, dining, travel, health and fitness.

Platinum Debit Card

- Additional dining plus card providing discounts at about 1600 restaurants across India and the Middle East.

- One reward point for every Rs.100 spent using the card.

- No limit on cashback amount.

- Global customer assistance.

- Emergency cash provision.

Shop Smart Card

- Unlimited cashback amount.

- 1 reward point for every Rs.100 spent using the card.

- Reward points can be redeemed for cash.

NRI Priority Debit Card

- Zero surcharges at petrol pumps.

- Exciting dining offers using the Dining Plus card.

- Increased spending limits of up to Rs.2,00,000.

- Emergency medical and travel assistance.

- No annual fee for using the card.

- Customer assistance anywhere anytime.

Along with SCB other banks like South Indian Bank Debit cards and HSBC Debit Cards also provides the best offers on Debit Cards.

FAQ’s Related to Standard Chartered Bank Credit Cards & Debit Cards

- What is the credit limit on credit cards?

2. Is there a separate credit limit for the add-on card?

3. What happens if the customer fails to pay the credit card bill before the due date?

4. What is the fee for using a credit card for overseas transactions?

5. What is the interest rate for late payment of credit bill?

6. How to report the loss of credit card?

7. How long does it take to obtain an add-on card?

8. How does the Standard Chartered Cash Back Platinum debit card work?

9. What are fees for using the Standard Chartered Cashback Platinum Debit card?

10. What is the advantage of using the Platinum Debit Card along with the Dining Plus Card?

11. What are the benefits of using priority infinite debit card?

12. What is the fee for using Standard Chartered Priority Infinite Debit Card?

13. How many reward points can be obtained with the use of Private Infinite Debit Card?

14. What is the annual fee for using Standard Chartered MasterCard Platinum Debit Card?

15. Is it possible to convert any of the existing Standard Chartered Bank debit cards to MasterCard Platinum Debit Card?